As the week drew to a close, a variety of publications, events, news updates, and regulatory developments unfolded. Let’s delve into a few of them.

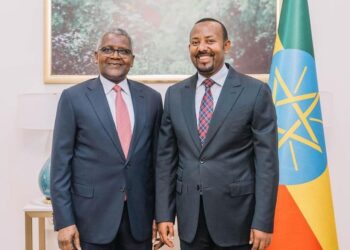

The startup scene is abuzz with excitement as Startup Ethiopia takes center stage at the science museum, showcasing a diverse array of startups across various sectors. Running from April 5 to 28, the event was inaugurated with the esteemed presence of Prime Minister Abiy Ahmed, who emphasized the forthcoming enactment of new regulations to bolster the ecosystem. Furthermore, engaging panel discussions will continue throughout the event, with the upcoming Monday session titled “Aligning Startups with Funding Opportunities,” featuring Dr. Brook Taye, Director General of ECMA, scheduled for 2:30 pm.

The NBE is publishing its first Financial Stability Report (FSR) to inform key stakeholders about the NBE’s analysis and assessment of key risks as well as its recommendations to mitigate these identified risks. The report is based on an assessment of risks and stress tests undertaken for the 2022-23 fiscal year. Read more

Semereta Sewasew, State Minister of Finance for Economic Cooperation, and her team visited the Ethiopian Capital Market Authority (ECMA) office. During the visit, the authority highlighted its significant progress in developing the regulatory framework, enhancing internal and external capacity building, conducting investor education, and creating a conducive environment for the capital markets. They also shared their upcoming plans leading to the market launch and beyond.

Regarding the exchange, Mr. Temi Popoola will join ESX’s board as NGX Group’s nominee, demonstrating NGX Group’s commitment to regional integration and collaboration within African capital markets. The Nigerian Exchange Group Plc (NGX) also confirmed its acquisition of a five percent stake in the Ethiopian Securities Exchange (ESX). Read more

Additionally, Tilahun Kassahun, the CEO of ESX, had an interview with CNBC Africa where he discussed key aspects concerning the development and progress of the exchange. He stated,

“In the coming weeks, we will reveal our assessment of technology platform providers, and the timeline for our launch will depend on the pace at which we complete the initial phases of deployment. Our aim is to commence operations before the end of this year, ideally in October or November.”

In the banking sector according to Wazema Radio, the state-owned Commercial Bank of Ethiopia has ceased loan disbursements effective Wednesday, April 3, 2024. The bank’s decision was made without providing a specific reason.

The other big news of the week was the opening of the export, import, retail and wholesale Sectors for foreigners. In a significant policy overhaul, the Ethiopian government has implemented reforms that will result in extensive changes to longstanding investment regulations, permitting foreign involvement in key economic sectors such as export, import, wholesale, and retail trade. Read more

Big decision awaits officials. Ethiopia may have to decide on a big currency devaluation sooner rather than later to secure a rescue loan from the International Monetary Fund (IMF), which left the country last week without reaching a much-needed deal with authorities. Read more

The first of First Consult’s annual publication of the Ethiopian microeconomy, The Blue Book, has been launched. The 2022-23 Blue Book provides exclusive insights into the Ethiopian economy by aggregating and connecting the dots between various macro-level studies and contextualizing them with insights and perspectives from businesses and consumers. Download here